single life annuity vs lump sum

Pays you the same exactly amount every month for the rest of your life you can simply compare the payout of the annuity with the payout you could. A large cash payment now.

When Can You Cash Out An Annuity Getting Money From An Annuity

SPIAs are commodities that need to be.

. Pension Annuity vs. Ad Have a 500000 portfolio. If the annuity is fixed ie.

Guaranteed income and protection against market downturns may be too good to true. Generally the option with a higher present value is the better deal. Federal law requires companies to offer a life annuity as an option.

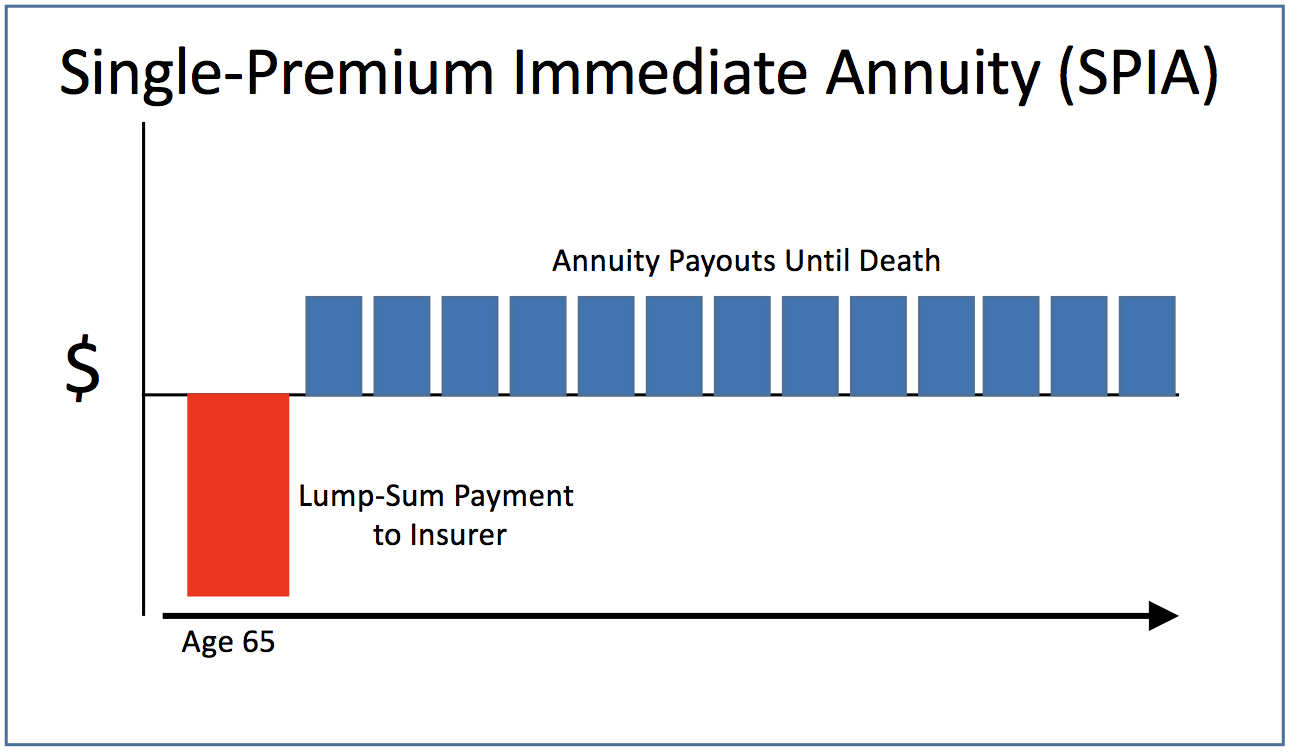

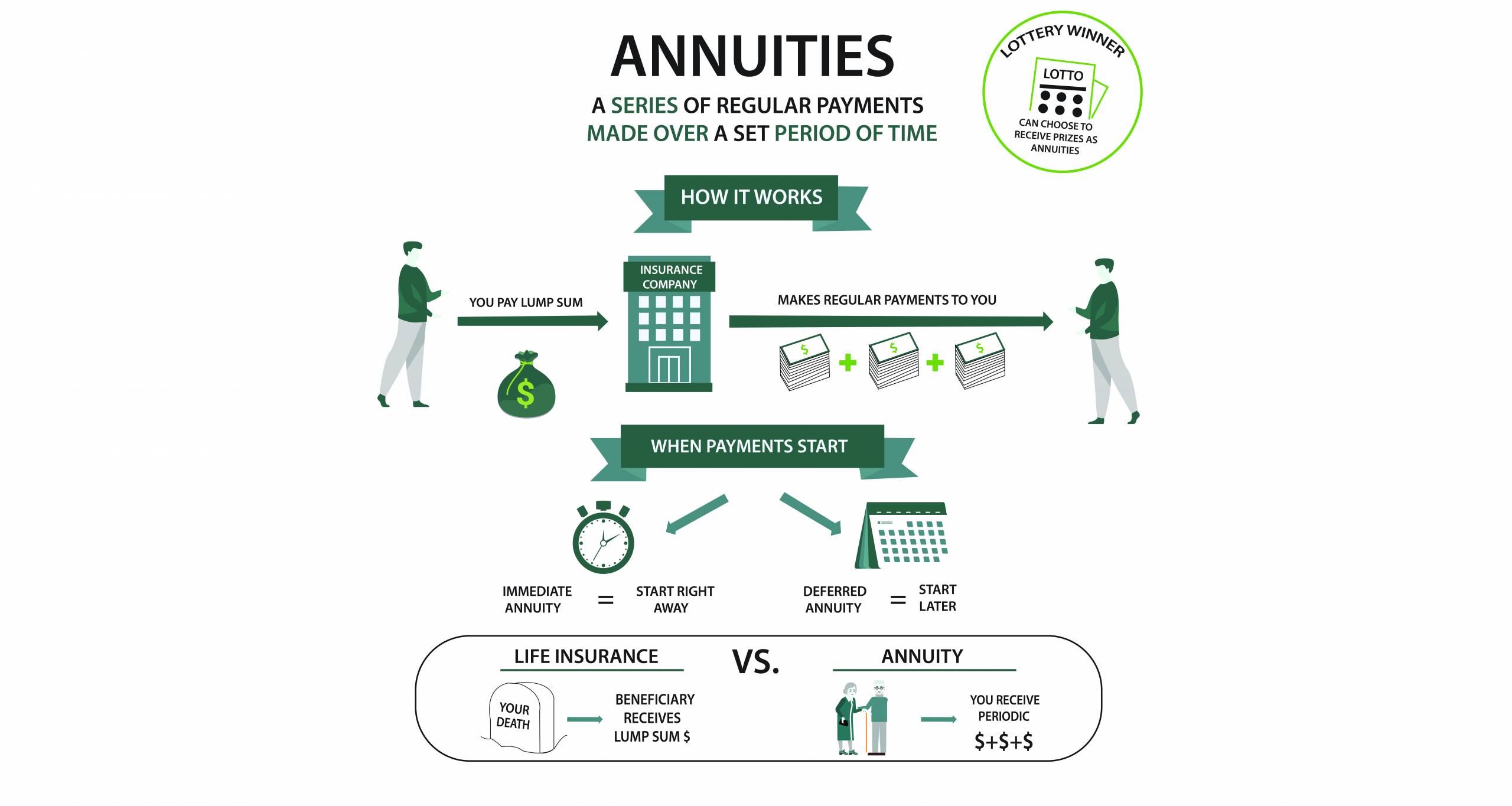

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Ad Learn More about How Annuities Work from Fidelity. Ad Safe Secure Compound Growth And The Highest Rates.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. Buy What You Need Not What Someone is Sellin Stan Haithcock The Annuity Man April 29 2020 There are over 10000 baby boomers. All other benefits are paid as a monthly annuity.

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is. Your employer has also offered to pay you a lump sum of 300000 if you want to give up your monthly pension payments. A life annuity with period certain is a hybrid option that provides lifetime.

Be sure to use a reasonable estimate of what your lump-sum investment might earn. Find out what the required annual rate of return required would be for. Ad Learn More about How Annuities Work from Fidelity.

Today we think a hypothetical conservative portfolio of 20 equities 50 bonds. PBGC pays lump sums only when a total benefit has a value of 5000 or less. Not surprisingly the monthly payout will be higher with a single-life annuity than if you opt for the joint-and-survivor benefit because the expected payment period is longer.

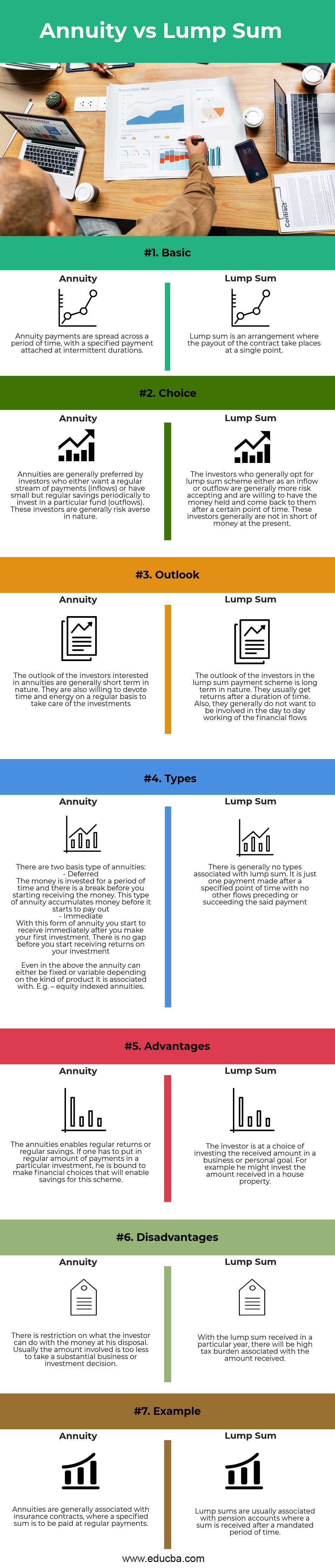

Get Your Free Report Now. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. The lump-sum payments attract tax all at once whereas the annuity attracts tax at a much lower.

The main benefit though is the flexibility to invest the. Life Annuity for a Pension Payout. Moreover the factor of inflation is.

Learn More on AARP. Is a lump sum offer from an employer a better choice than a pension annuity for life. A lump sum annuity payout may seem to be a good option especially if you wish to exercise complete control over your financial portfolio.

The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing. Truth is annuities are often the better deal says Bob Kargenian an Orange California-based financial adviser noting that companies offering these buyouts are doing so. Get the free report insurance companies dont want you to read.

In the end the payments from annuity add up to a larger sum in comparison to the lump sum. After the date of your first payment you cannot. If you take the 2500 per month then when you do.

The former provides an immediate up-front amount say 300000 but the pension. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

By continuing payments to a beneficiary for a certain. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average.

A premature death reduces the value of a single life annuity because payments end with the annuity holders death. Individuals with employer-sponsored defined contribution plans or.

Lottery Payout Options Annuity Vs Lump Sum

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

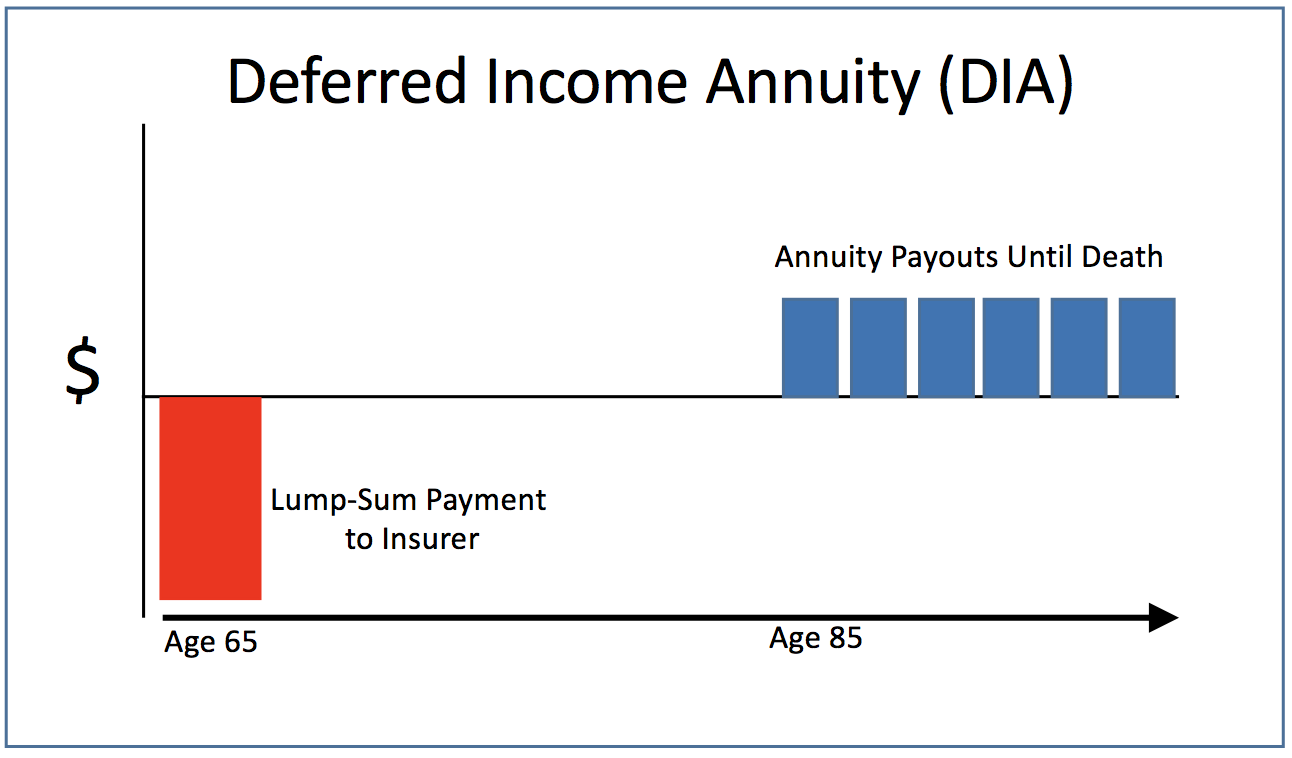

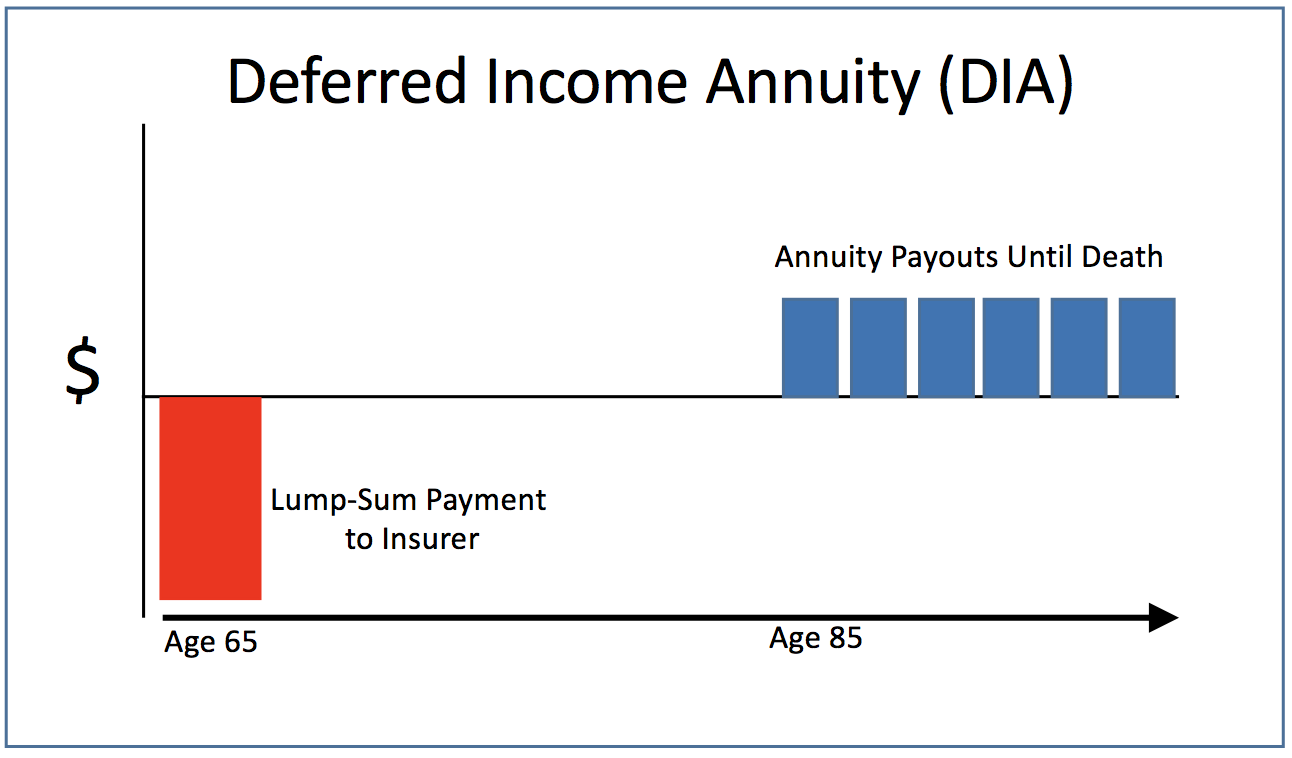

Income Annuities Immediate And Deferred Seeking Alpha

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Beneficiaries Inherited Annuities Death

Annuity Vs Lump Sum Top 7 Useful Differences To Know

How Much Income Do Annuities Pay Due

Annuity Beneficiaries Inheriting An Annuity After Death

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Strategies To Maximize Pension Vs Lump Sum Decisions

Should You Take The Annuity Or The Lump Sum If You Win The Lottery