child tax credit 2021 dates direct deposit

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. By August 2 for the August.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022.

. 1400 in March 2021. 15 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Child tax credit dates 2021 latest August 30 deadline to opt-out of September payments as parents flock to IRS portal. The credit amount was increased for 2021. A childs age determines the amount.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. The 2021 child tax credit payment dates along with the deadlines to opt out are.

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll. The payments will be paid via direct deposit or check.

Here are the official dates. The iPhone at 15 Louis Vuitton smartwatch CES 2022 takeaways Attack on Titan final season Golden Globes 2022 How to find at-home COVID-19 tests. The child tax credit is usually worth 2000 per.

The IRS has created a special Advance Child Tax Credit 2021 page designed to provide the most up-to-date information about the credit and the advance payments. The payments will be made either by direct deposit or by paper check depending on. Advance payments All payment dates.

Starting in 2021 the taxes you file in 2022 the plan increases the Child Tax Credit from 2000 to. The September child tax credit payment was sent out via direct deposit and USPS on the 15th Credit. Families who requested the payment via paper check should allow up to a week to receive the check via postal mail.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments.

The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. To reconcile advance payments on your 2021 return. Up to 3600 for each qualifying child under 6.

Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days to a week later. Parents income matters too. Among other things it provides direct links to the Child Tax Credit Update Portal as well as two other online tools the Non-filer Sign-up Tool and the Child Tax Credit Eligibility.

By making the Child Tax Credit fully refundable low- income households will be. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. The schedule of payments moving forward will be as follows.

Get your advance payments total and number of qualifying children in your online account. IR-2021-153 July 15 2021. Lets condense all that information.

Each payment will be up to 300 for each qualifying child under the age of 6 and. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

In previous years 17-year-olds werent covered by the CTC. Those who have already signed up will receive. This first batch of advance monthly payments worth.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Newer Post Older Post Home.

Enter your information on Schedule 8812 Form. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 13 opt out by Aug.

How Next Years Credit Could Be Different. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. If your July child tax credit check was sent via mail rather than direct deposit update your banking information before the next payment.

The remaining 1800 will be. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Some Americans voiced frustration on Twitter today when their direct deposits did not post by the morning of September 15.

In July 2021 the IRS started making advance monthly payments of the 2021 Child Tax Credit. Half of the money will come as six monthly payments and. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The credit was made fully refundable. The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start.

Irs Still Being Processed Vs Being Processed Refundtalk Com Irs Process Messages

Childctc The Child Tax Credit The White House

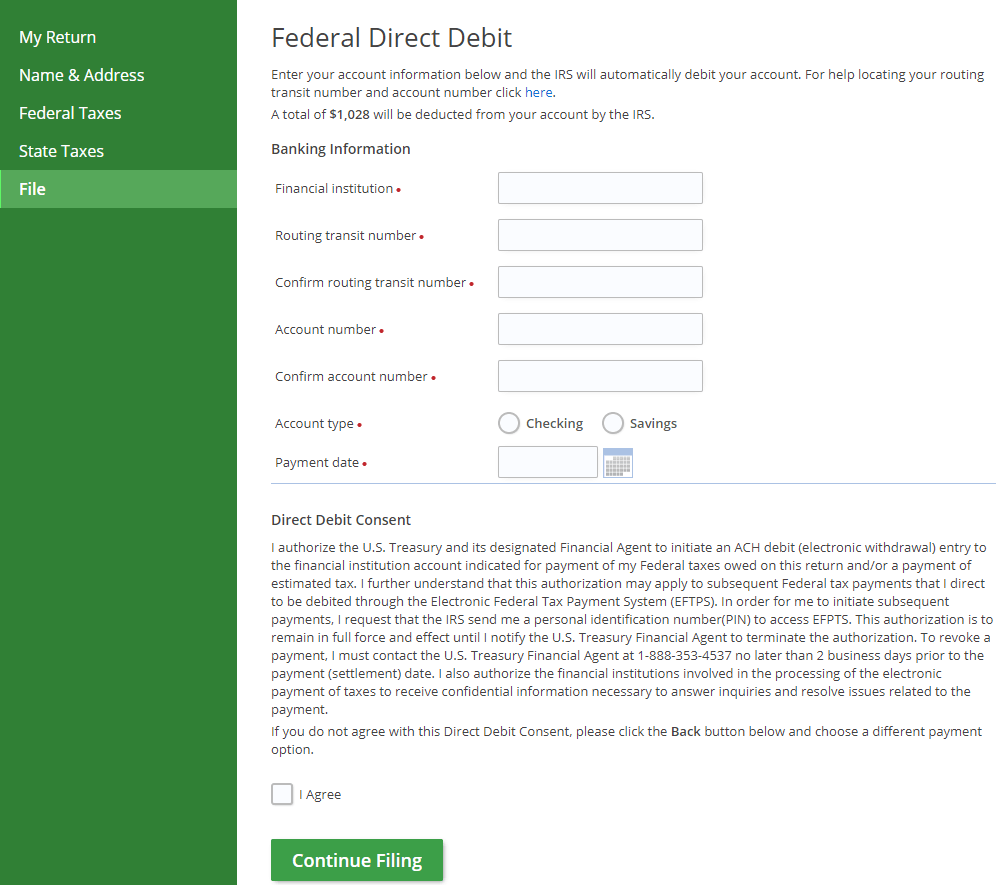

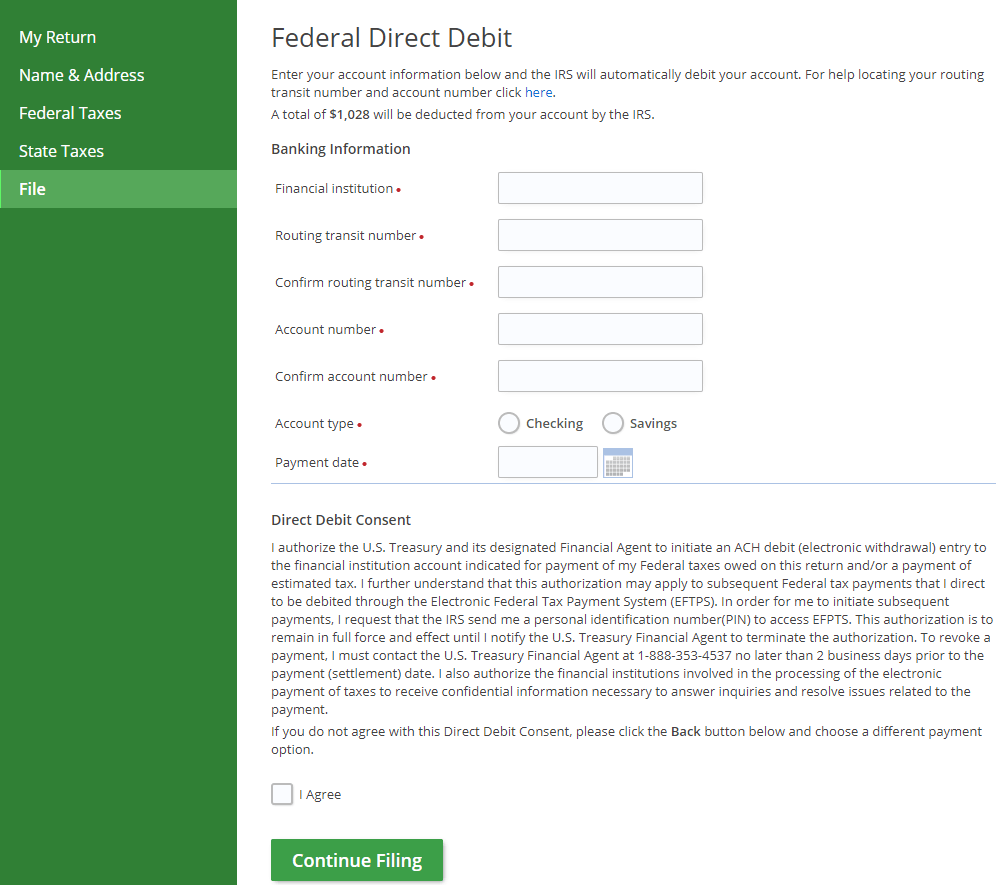

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Get Our Sample Of Generic Direct Deposit Form Template Form Directions Deposit

2021 Child Tax Credit Advanced Payment Option Tas

Advance Child Tax Credit Will Be Paid Starting July 15 Nextadvisor With Time

Paypal Payroll Direct Deposit Paypal Us

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Direct Deposit Your Tax Refund Fidelity

Deposits Of 1 200 Stimulus Checks Will Start Arriving Wednesday Tax Refund Payroll Checks Money Template

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Get Your Irs Refund Cycle Chart 2022 Here Diy Taxes Tax Refund Refund

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

Around What Time Of The Day Does The Irs Refund Deposits Into Bank Accounts Quora